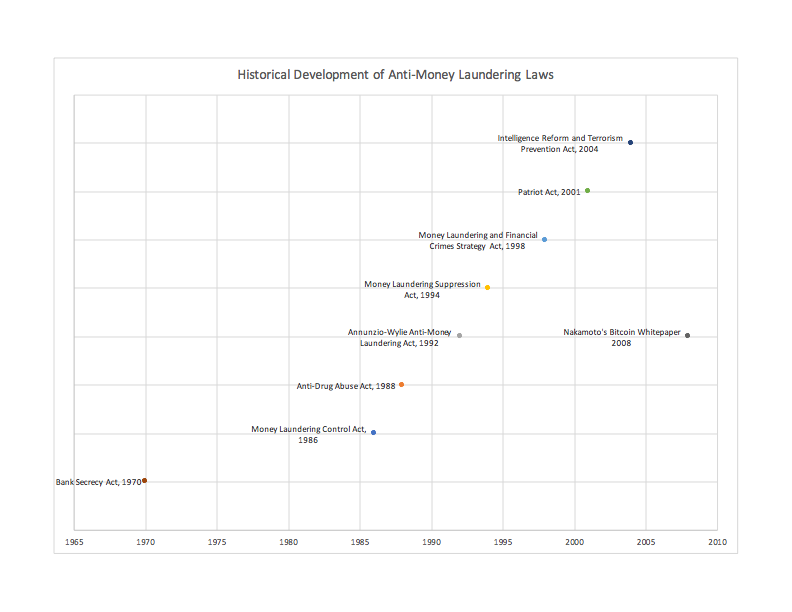

Money laundering is a process of taking the proceeds of criminal activity and making them appear as if they have been lawfully obtained (criminalized in the US under 18 U.S. Code § 1957). UNODC estimates the scale of money laundering at 2-5% of global GDP. Criminal activities in narcotics and later terrorism were the primary motivation for increased surveillance of financial transactions in the US and abroad under the rubric of Anti Money Laundering (AML) enabling legislation, starting with the Bank Secrecy Act of 1970 (BSA), (31 U.S.C.A. §§ 5311 et seq.).

UN activities through the Office on Drugs and crime have a global program encouraging similar legislation and regulation in other countries as well as related UN conventions starting with the 1988 UN convention against Illegal traffic in Narcotic drugs. These international legal coordination activities are relevant for crypto enthusiasts because the peer-peer networks underlying many cryptocurrencies are inherently international. UN resolutions in 2005 and 2006 also recognized the importance of more specific recommendations from the Financial Action Task Force (FATF). FATF recently issued their Guidance for a risk based approach to Virtual Assets and Virtual Asset Service Providers; this provides common terminology and interpretation of how other FATF regulations should be interpreted in the case of virtual assets such as crypto currencies (whether fiat backed or not) and considering the roles of virtual asset service providers that provide services to exchange cryptocurrencies (whether to fiat currencies or other virtual assets), as well as some comparisons of the relevant regulatory regimes in several different countries. All of the enabling legislation predates the release of Nakamoto’s Bitcoin whitepaper in 2008.

At the federal level, FINCEN regulates money transmission in coordination with State regulations and laws on money transmission. To the extent that a virtual asset is a security, the SEC has regulatory and enforcement authority and securities require registration with FINRA. Virtual assets that may qualify as commodities or derivatives (e.g. futures) would be within the jurisdiction of the CFTC; and require registration with the National Futures Association (NFA). US financial sanctions (which apply to transactions in cryptocurrencies as well as fiat currency) are administered by OFAC.

Many cryptocurrency exchanges fall within the category of Money Transmitters under the BSA, thus requiring registration with FINCEN and additional state licensing. State money transmitter laws vary and not all State address cryptocurrencies explicitly. The money transmitter laws and regulations are not specific to cryptocurrencies and include some potentially broad categories such as Money Service Businesses (MSBs). The MSB definition in §1010.100 (ff) is fairly complex and broad interpretation may imply that even businesses accepting cryptocurrencies need to register as MSBs.

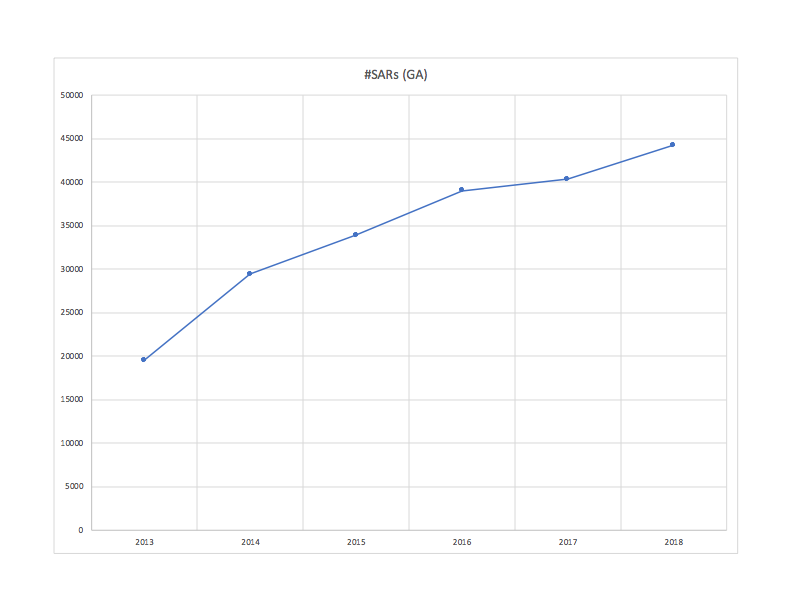

FINCEN registration and AML reporting and other AML compliance program requirements are identified under 31 CFR Chapter X. In particular, reporting by MSBs is required for Currency Transaction Reports (CTRs) (under §1022.310) and Suspicious Activity Reports(SARs) (under §1022.320), with threshold transaction amounts and red flag indicators triggering reporting. Money transmitters have been required to submit electronic SARs and CTRs since 2013. The number of CTRs is largely driven by economic transaction activity; SARs are more driven by the compliance programs of the Money Transmitters. While SARs are not specific to cryptocurrency transactions, FINCEN publishes aggregate statistics on SARs; and, 10s of thousands of SARs are generated in a year within a single state.

FINCEN also recently issued an advisory on illicit activity involving convertible virtual currency. They have also initiated enforcement actions against cryptocurrency exchanges that failed to register as MSBs.

Businesses involved with cryptocurrencies clearly need to review their registration and compliance procedures for conformance with the relevant AML regulations in their jurisdictions. This is not just a US phenomenon – since the FATF’s Guidance for a risk based approach to Virtual Assets and Virtual Asset Service Providers, other jurisdictions (e.g., the Swiss FINMA) are issuing similar AML guidance even as they proceed with licensing crypto exchanges.